According to an investigation by CBS, American debt grows by $75 million every hour. In total, Americans owe about $850 billion in credit card debt — and credit card debt is only one of many kinds, accounting for just 5.5% of average household debt in the U.S. If you’re one of these Americans drowning in debt, the good news is…

Read More

According to an investigation by CBS, American debt grows by $75 million every hour. In total, Americans owe about $850 billion in credit card debt — and credit card debt is only one of many kinds, accounting for just 5.5%…

Read More

Between irresponsible lending practices by large banks and creditors, as well as a tough economic climate with a lack of high paying jobs, many Americans are finding themselves going deeper and deeper into debt. In fact, American consumers are a…

Read More

Irresponsible lending practices by large lenders and creditors, in addition to an economic downturn which resulted in a large number of layoffs and lack of high-paying jobs, has resulted in many Americans falling deeper and deeper into debt. In fact,…

Read More

It goes without saying that being in debt can be a stressful experience, and with American consumers being nearly $11.13 trillion in debt, of which an estimated $894.8 billion is credit card debt, everyone is feeling the pressure to become…

Read More

If you’re like most Americans, you’re carrying some form of debt. Whether it’s credit card debt, medical bills, or student loan debt, we all seem to have it. It’s estimated that American debt continues to steadily rise by an estimated…

Read More

More American consumers are finding themselves falling deeper into debt, and the numbers continue to rise. According a recent CBS news report, American debt increases by a staggering $75 million each hour alone. Between a faltering economy which resulted in…

Read More

American debt is at an all time high, with consumers owing a total of $11.13 trillion, of which an estimated $894.8 billion is credit card debt. Though the economy, housing, and job markets are slowly showing signs of recovery, American…

Read More

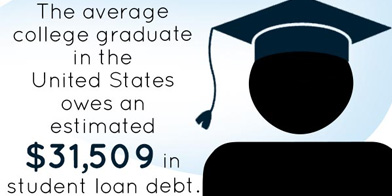

When you look at the statistics, the United States seems like it would receive a low grade for financial health. Currently, the average American is in $2,200 of credit card debt. If they went to college, this same American could…

Read More

Debt is a serious business in the United States: according to CBS News, American debt rises by $75 million each hour, creating a total of $11.13 trillion in money owed. This shocking amount has a number of causes, from medical…

Read More

Living beyond your means is incredibly easy to do, unfortunately. In fact, the average American household income has grown by 26% in the past 12 years, but the cost of living has gone up 29% in that same time period.…

Read More

Debt is something that thousands of Americans struggle with. Even though we are roughly seven years post-recession, many American consumers are still grappling with its devastating effects, and struggling to manage student loan, medical, and credit card debt. As such,…

Read More

It’s that time of year again, folks. The holiday shopping season is in full swing. Though Black Friday and Cyber Monday both reported less than stellar sales due to the changing spending patterns and habits of shoppers, consumer confidence in…

Read More

‘Tis the season to rack up more credit card debt. Between tempting store credit card offers and irresistible sales, it’s easy for holiday shoppers to accrue more debt than they initially anticipated or even wanted. According to 2013 research by…

Read More

You’ve probably heard commercials and seen advertisements for plenty of debt management programs in the past few years, most of which promise to fix all your financial problems and make your debt go away like magic. The hard truth is…

Read More

The new year provides us with the opportunity to start fresh by shedding our old bad habits. As such, the new year is the perfect time review your finances and get back on track. Now that the chaos of the…

Read More

The winter holiday season including Thanksgiving, Christmas, and New Year’s Day is often considered the “most wonderful” time of the year; however, it’s also considered the most expensive. While credit cards account for just 5.5% of the total debt in…

Read More

Debt is something that nearly every American has. Whether it’s credit card debt, student loan debt, or medical bills — or a combination of all three — the majority of Americans are carrying some form of debt. In fact, a…

Read More

If you feel as if your life has been taken over by your debit, then it is time to start looking into different debt relief options. Debt is all too common in the U.S., as the average American family with…

Read MoreNo item found.